As we transition from summer into fall, the Portland Metro housing market is telling a story that’s become familiar over the past few months. After reviewing the latest data from July and August 2025, along with national market trends, we’re seeing patterns that offer both opportunities and possible points of concern for adults 55+ making housing decisions.

The Current Market Landscape: A Tale of Two Months

The Portland Metro market showed interesting shifts between July and August 2025, reflecting broader national trends while maintaining its own regional characteristics.

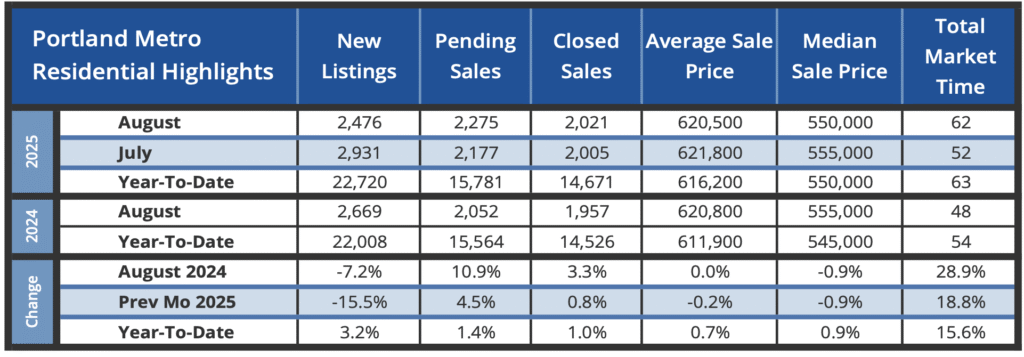

July 2025 Highlights:

- Median home price: $555,000

- Average days on market: 52 days

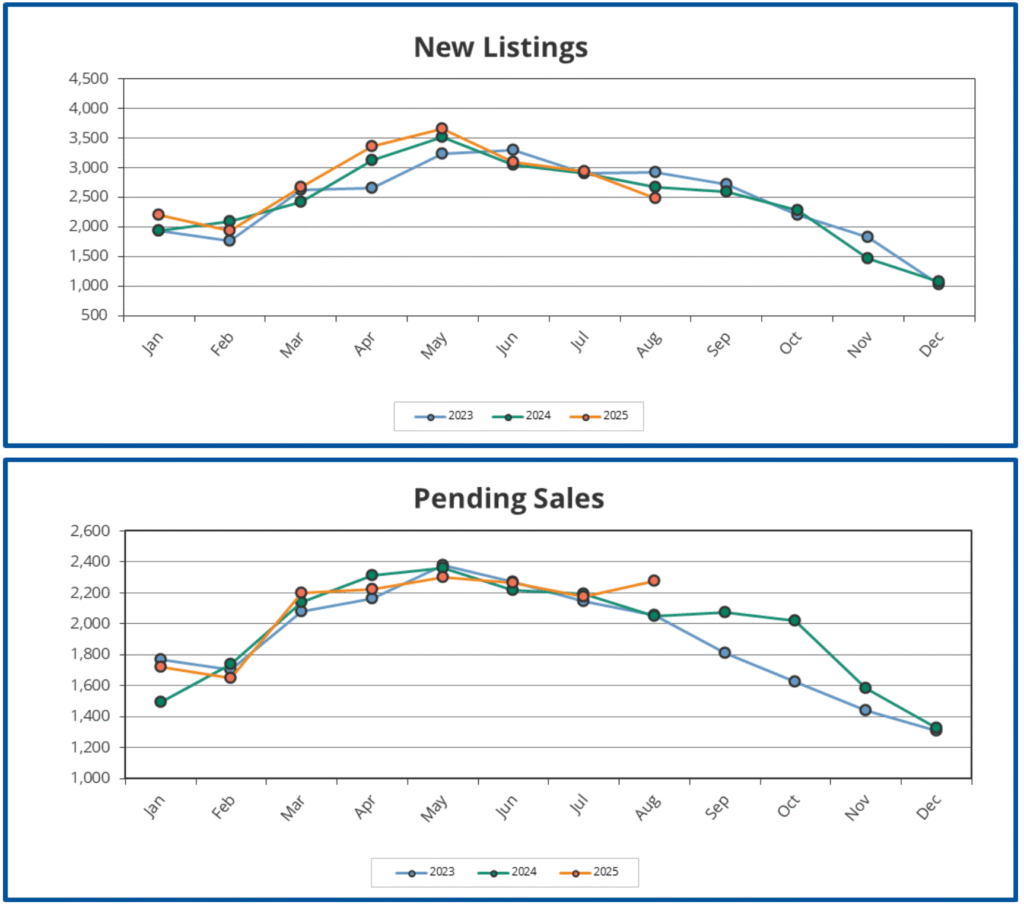

- New listings: 2,931 (up 0.9% from July 2024)

- Closed sales: 2,005 (down 3.4% from July 2024)

- Inventory: 3.7 months

August 2025 Developments:

- Median home price: $550,000 (slight decrease)

- Average days on market: 62 days (10-day increase)

- New listings: 2,476 (down 7.2% from August 2024)

- Closed sales: 2,021 (up 3.3% from August 2024)

- Inventory: 3.5 months

What does this mean for you? The market continues to provide time for careful planning—something that aligns perfectly with the approach many adults 55+ prefer when making significant housing decisions.

Understanding the “Cancellation Trend” and What It Means Locally

National headlines have highlighted rising purchase cancellations, with some markets seeing over 20% of agreements fall through. Portland sits in the middle of this trend at 14.2% in July—lower than Sun Belt cities like San Antonio (23%) or Fort Lauderdale (21.3%), but higher than the historic norm.

For our Portland market, this trend reflects several factors:

- Buyers taking time to find the right fit rather than settling

- More inventory providing additional options

- The ability to negotiate terms and pricing

- Increased focus on homes that show well both online and in person

What this means for 55+ buyers: You have more negotiating power and time to make decisions. However, properties that are well-maintained, properly staged, and competitively priced are still moving efficiently.

What this means for 55+ sellers: First impressions matter more than ever. Professional photography, minor updates, and realistic pricing strategies become crucial for success.

Neighborhood Spotlight: Where Values Meet Lifestyle

Portland’s diverse communities offer varying price points and lifestyle options. Here’s how different areas performed in August 2025:

Value-Focused Communities:

- Gresham/Troutdale: Median $483,500 (up 2.7% year-over-year)

- Hillsboro/Forest Grove: Median $521,900 (up 0.5% year-over-year)

- Columbia County: Median $458,000 (up 3.6% year-over-year)

Mid-Range Options:

- Milwaukie/Clackamas: Median $570,000 (down 0.7% year-over-year)

- Beaverton/Aloha: Median $550,000 (up 0.2% year-over-year)

- Tigard/Wilsonville: Median $619,900 (up 1.3% year-over-year)

Premium Communities:

- Lake Oswego/West Linn: Median $850,000 (up 1.8% year-over-year)

- West Portland: Median $658,800 (up 2.7% year-over-year)

These variations highlight the importance of exploring different communities based on your lifestyle preferences, proximity to healthcare, and budget considerations.

Price Range Analysis: Where 55+ Buyers Are Active

Popular Rightsizing Ranges:

- $400K-$600K range: 39.3% of all sales (799 homes in August)

- $600K-$800K range: 23.3% of all sales (469 homes)

- $300K-$500K range: 29.7% of all sales (601 homes)

Combined, these three ranges represent over 92% of market activity—exactly where most downsizing and rightsizing decisions occur. This concentration suggests strong liquidity and options within the price ranges most relevant to adults 55+.

Fall Market Advantages: Why Timing Favors Thoughtful Buyers

As we move into fall, several factors create advantages for deliberate home buyers:

Reduced Competition:

- Families with school-age children typically pause home searches

- Vacation season ends, bringing serious buyers back to market

- Holiday preparations limit casual browsing

More Seller Flexibility:

- Motivated sellers who’ve been on market through summer

- Increased willingness to negotiate on price and terms

- Higher likelihood of seller concessions for repairs or closing costs

Better Inspection Conditions:

- Seasonal issues (heating systems, roof conditions) become apparent

- Weather conditions allow for thorough property evaluation

- Contractors and inspectors have better availability

Strategic Timing for 2026:

- Move before winter weather complications

- Settle in before holidays for family gatherings

- Take advantage of year-end tax planning opportunities

Fall Market Considerations/Concerns

However, fall buying also requires awareness of certain factors:

Reduced Inventory:

- Fewer new listings typically come to market

- Best properties may sell quickly despite seasonal slowdown

- Limited selection in some neighborhoods or price ranges

Weather Impact:

- Rain can complicate moving logistics

- Shorter days limit showing availability

- Seasonal maintenance needs become evident

Holiday Timing:

- Thanksgiving and December holidays can slow processes

- Lender and title company schedules may have holiday impacts

- Moving companies book up during popular timeframes

The Uncertainty Factor: Navigating Political and Economic Unknowns

The potential for a “national housing emergency” declaration adds an element of uncertainty to all housing decisions. While Treasury Secretary Bessent’s comments about possible fall action remain vague, they reflect the serious nature of national affordability challenges.

For Portland-area residents, this uncertainty manifests in several ways:

- Mortgage rate volatility as markets react to policy speculation

- Builder and buyer hesitation pending clearer direction

- Potential for rapid policy changes affecting zoning, construction, or financing

Our recommendation: Focus on your personal housing needs and timeline rather than trying to time political developments. Good housing decisions based on your lifestyle, health, and financial situation remain sound regardless of broader policy changes.

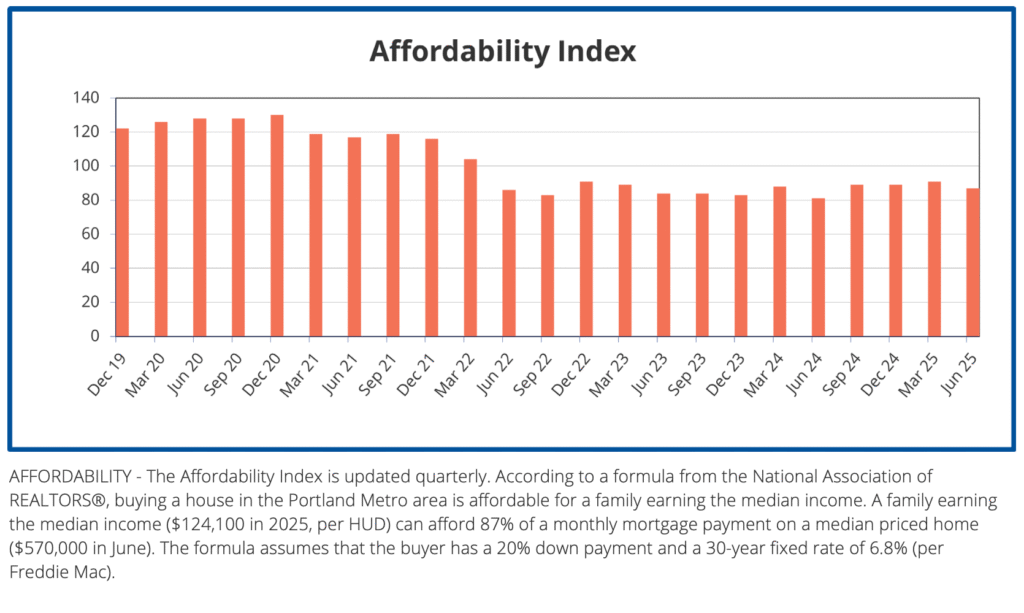

What the Data Tells Us About Affordability

Portland’s affordability index shows families earning median income ($124,100) can afford 87% of mortgage payments on a median-priced home—challenging but not impossible. For many 55+ buyers with accumulated equity, this translates to reasonable monthly payments when downsizing.

The key insight: inventory levels of 3.5 months provide enough choice without creating panic buying conditions. This balanced environment favors buyers who can move decisively on well-priced properties.

Looking Ahead: Preparing for Your Next Move

Whether you’re considering downsizing, rightsizing, or aging in place with modifications, the current market offers opportunities for those prepared to act thoughtfully:

For Sellers:

- Price competitively based on recent comparable sales

- Invest in professional photography and minor staging improvements

- Consider offering buyer incentives (closing cost assistance, warranty programs)

- Be prepared for longer marketing times but potentially better qualified buyers

For Buyers:

- Take advantage of reduced competition and motivated sellers

- Don’t rush—inventory levels support careful decision-making

- Focus on homes that meet your long-term accessibility and maintenance preferences

- Consider properties that may need minor updates but offer good bones and location

The Bottom Line for Portland’s 55+ Community

Portland’s housing market continues to provide opportunities for thoughtful participants. While national uncertainty adds complexity, local fundamentals remain stable. The combination of reasonable inventory levels, motivated sellers, and reduced competition creates conditions that favor deliberate decision-makers—exactly the approach most adults 55+ prefer.

The key is working with professionals who understand both the local market dynamics and the unique considerations of housing transitions later in life. Whether you’re ready to move now or planning for the future, understanding these trends helps you make informed decisions that support your long-term goals.

Ready to explore your options in today’s market? Every housing decision is personal, and local expertise makes all the difference. Let’s discuss how current market conditions align with your specific goals and timeline.

Schedule your complimentary consultation today to discover how we can help you navigate Portland’s evolving housing landscape with confidence and clarity.

Silver Compass Property Group specializes in serving adults 55+ throughout the Portland Metro area. Our approach prioritizes your peace of mind, whether you’re buying, selling, or planning for the future.

Thanks for reading : )

Peter Lindberg

Lead Broker – Silver Compass Property Group

503-806-4277