Welcome to our comprehensive Portland housing market July 2025 analysis, where we’ll examine how the buyer’s market trends we identified in our June analysis have continued to develop, both locally and nationally. The patterns we’ve been tracking for several months are now clearly established, with new data confirming that buyers have gained significant leverage across most price ranges.

Recent national housing market analysis shows that this isn’t just a Portland phenomenon. Across the United States, housing markets are experiencing what experts are calling the most buyer-friendly conditions in nearly a decade. For Portland’s 55+ community, understanding both the national context and local market dynamics will help inform your housing decisions whether you’re considering selling, buying, or staying put.

The data we’ll explore today reinforces themes from our previous reports while revealing new considerations, particularly for homes that may need updating to compete effectively in today’s more selective buyer environment.

Portland Housing Market July 2025: The Trends Continue

Key Market Metrics

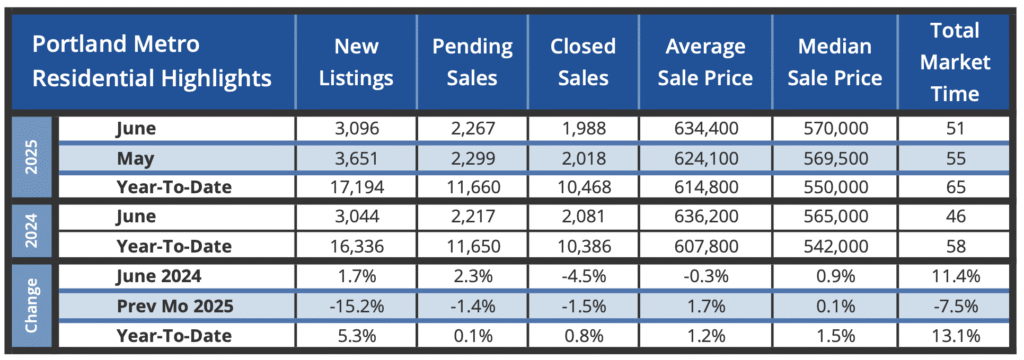

Portland’s June data from RMLS confirms the buyer’s market momentum we identified in previous months, with several metrics showing accelerated movement in buyers’ favor.

Market Activity:

- New listings: 3,096 properties (up 1.7% from June 2024, down 15.2% from May 2025)

- Pending sales: 2,267 offers accepted (up 2.3% from June 2024, down 1.4% from May 2025)

- Closed sales: 1,988 transactions (down 4.5% from June 2024, down 1.5% from May 2025)

- Inventory: 3.6 months of supply (up from 3.3 months in May, up from 2.6 months in June 2024)

Price Performance:

- Average sale price: $634,400 (down 0.3% from June 2024, up 1.7% from May 2025)

- Median sale price: $570,000 (up 0.9% from June 2024, up 0.1% from May 2025)

- Time on market: 51 days (up from 46 days in June 2024, down from 55 days in May)

Understanding the Portland Housing Market July 2025 Data

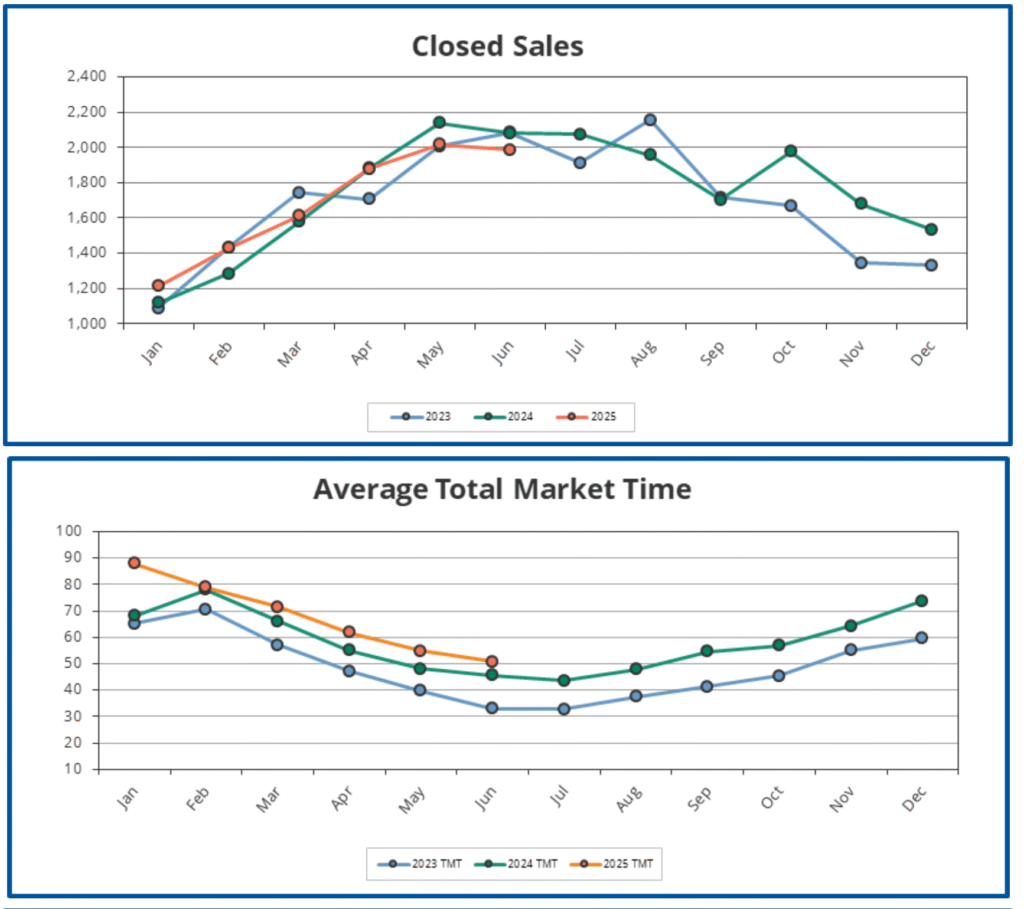

The June data tells a clear story of market rebalancing in the Portland housing market July 2025 environment. While new listings increased year-over-year, the more significant trend is the growing gap between available homes and buyer activity. Closed sales dropped 4.5% compared to June 2024, while inventory increased to 3.6 months—the highest level we’ve seen since early 2019.

Perhaps most telling is the persistent pattern of homes taking longer to sell. At 51 days average market time, properties are spending nearly 11% longer on the market than they did last June. This represents a fundamental shift from the rapid sales that characterized Portland’s market through 2023 and much of 2024.

National Context: Portland Reflects Broader Housing Market Trends

The Big Picture Shift

As we discussed in our June report, Portland’s market changes align with national trends, but recent economic developments are accelerating these patterns. National data shows that buying an entry-level home now costs more than twice as much per month as renting—a milestone not seen since 2006, just before the housing market correction.

This affordability crisis particularly affects first-time buyers, which has implications throughout the housing chain. When younger buyers can’t enter the market, it reduces demand for starter homes and affects move-up buyer patterns that often drive sales in higher price ranges where many 55+ homeowners are positioned.

Policy and Economic Impacts

Recent federal policy changes are adding complexity to the housing market landscape. The passage of the “One Big Beautiful Bill” includes provisions that eliminate several energy efficiency tax credits that had been supporting home construction and renovation. For the construction industry, these changes combined with tariff-related material cost increases are creating additional headwinds.

As one economist noted, “builders that were expecting the credit will likely pass the cost on to consumers or cancel the construction of new homes altogether, further disrupting the housing supply and increasing costs.” This dynamic could mean fewer new homes coming to market, which traditionally would support existing home values, but current buyer hesitation is offsetting this potential benefit.

Interest Rate Reality

Mortgage rates remain a significant factor in buyer behavior. With rates continuing to hover in the upper 6% to low 7% range, many potential buyers are staying on the sidelines hoping for improvement. However, given current economic policies and inflation concerns, experts anticipate that rates may remain elevated throughout 2025.

This creates a challenging dynamic: while inventory increases and gives buyers more options, affordability constraints limit the pool of qualified buyers, particularly in price ranges below $600,000.

What This Means for Portland’s 55+ Homeowners

For Those Considering Selling: Market-Ready Matters More Than Ever

In today’s buyer’s market, the condition and presentation of your home has become increasingly critical. With buyers having more options and taking longer to make decisions, properties that aren’t move-in ready face particular challenges.

The “Market-Ready” Reality: If you’ve been in your home for many years without recent updates, this market requires honest assessment of your property’s competitive position. Features that were acceptable in a seller’s market—dated kitchens, original flooring from the 1980s, older electrical systems—may now significantly impact buyer interest and offer prices.

Recent national data shows that 37% of homebuilders are now offering price reductions and incentives to attract buyers. This new-construction competition means existing homes must offer compelling value propositions, whether through pricing, condition, or both.

Strategic Renovation Considerations: While major renovations aren’t always financially prudent before selling, some updates can make meaningful differences in today’s market:

- Fresh paint and flooring: These improvements offer high impact for relatively modest investment

- Kitchen and bathroom updates: Even minor refreshes can significantly improve buyer perception

- Safety and efficiency improvements: Updated electrical, HVAC tune-ups, and energy efficiency measures appeal to today’s buyers

- Decluttering and staging: With longer market times, professional presentation becomes more valuable

Pricing Strategy in the New Environment

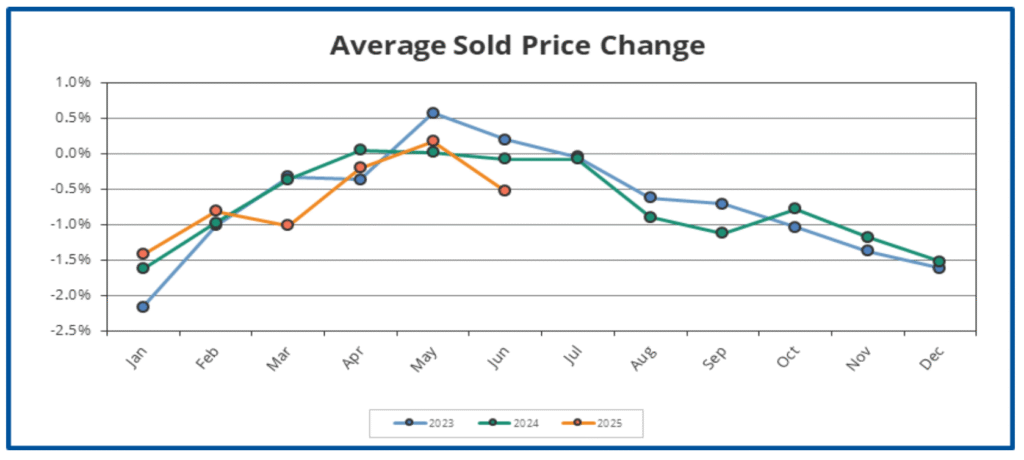

Portland’s year-over-year price performance shows the market’s resilience—median prices are still up 0.9% from June 2024. However, the trend toward longer market times and increased inventory suggests that pricing strategy has become more nuanced.

For homes under $600,000: This segment faces the most pressure from affordability constraints. First-time buyers are increasingly priced out, and those who remain in the market are highly selective about condition and value.

For homes $600,000 to $1.2 million: This represents the sweet spot for many 55+ buyers and move-up purchasers with substantial equity. However, even this segment is showing price sensitivity, with buyers taking advantage of increased negotiating power.

For luxury properties above $1.2 million: Higher-end properties are experiencing the most dramatic shift, with market times extending significantly and price negotiations becoming standard.

Timing Considerations

The data suggests that current market conditions may represent a “window” for sellers who need to move. While we’re not seeing dramatic price declines, the trajectory toward increased buyer leverage appears likely to continue through the remainder of 2025.

National economists predict modest price decreases by year-end, and Portland’s market trends suggest we may see similar patterns locally. For sellers with flexibility, acting while equity positions remain strong may be preferable to waiting for potentially more challenging conditions.

Opportunities for 55+ Buyers

Increased Leverage and Selection

For Portland buyers with strong financial positions, current market conditions offer advantages not seen in recent years:

Expanded inventory: With 3.6 months of supply compared to 2.6 months last June, buyers have significantly more properties to consider and can afford to be selective about condition, location, and features.

Negotiating opportunities: Properties that have been on the market longer than the 51-day average often present opportunities for price negotiations, favorable terms, or seller concessions on repairs or closing costs.

Reduced competition: The frenetic bidding wars and waived contingencies that characterized recent years have largely disappeared, allowing for more thoughtful decision-making and proper due diligence.

Strategic Considerations for 55+ Buyers

Focus on long-term value: With the market transitioning, prioritize properties that will serve your needs for 10-15 years rather than trying to time short-term market movements.

Consider properties needing updates: Homes requiring cosmetic improvements may offer significant value opportunities, particularly if you’re planning renovations anyway for aging-in-place modifications.Evaluate total cost of ownership: With longer market times, you can thoroughly assess properties for ongoing maintenance needs, energy efficiency, and accessibility features.

Looking Ahead: What to Watch

Key Market Indicators

Several factors will influence how Portland’s buyer’s market evolves through the remainder of 2025:

Inventory trends: The gap between new listings and buyer activity continues to widen. If this pattern persists, we could see inventory reach 4+ months by fall, which would represent a clear buyer’s market by traditional metrics.

Economic policy impacts: Continued uncertainty around trade policies, construction costs, and interest rates may keep buyer hesitation elevated even as inventory increases.

Seasonal patterns: Traditionally, fall markets see reduced activity. In a buyer’s market environment, this seasonal slowdown could create additional negotiating opportunities for buyers and pricing pressure for sellers.

National Economic Context

The broader economic environment continues to influence local housing markets. Construction slowdowns due to material cost increases mean fewer new homes will compete with existing inventory, but buyer affordability constraints may offset this potential benefit to existing home values.

Portland’s fundamental strengths—limited buildable land, regional desirability, and economic diversity—provide underlying market stability. However, these factors work over longer time horizons and may not prevent short-term market adjustments.

Practical Guidance for Portland’s 55+ Community

For Current Homeowners Planning to Stay

Monitor your equity position: While Portland home values remain relatively stable, be aware that appreciation rates are slowing. This doesn’t threaten your existing equity but may affect future borrowing capacity or refinancing opportunities.

Consider strategic improvements: If you’re planning to remain in your home long-term, current market conditions may present opportunities for renovation projects as contractors face reduced demand from the construction slowdown.

Evaluate aging-in-place modifications: With construction material costs potentially stabilizing as supply chain issues resolve, this could be an opportune time for accessibility improvements or efficiency upgrades.

For Those Planning Major Housing Changes

Get current market analysis: Whether buying or selling, pricing strategies should be based on very recent sales data rather than older comparables or listing prices.

Prepare for longer timelines: Adjust expectations for both marketing time if selling and search time if buying. The rapid transactions of recent years are no longer the norm.Focus on fundamentals: While market timing considerations matter, housing decisions should primarily align with your lifestyle needs, health considerations, and financial planning rather than short-term market movements.

Conclusion: Navigating the New Market Reality

Portland’s June data confirms that the buyer’s market trends we’ve been tracking have solidified into the new market reality. For our 55+ community, this shift brings both challenges and opportunities that require thoughtful consideration and strategic planning.

The key themes emerging from this market transition include the increased importance of home condition and presentation, the need for realistic pricing strategies, and the value of understanding both national and local market dynamics. While the seller-favorable conditions of recent years have ended, Portland homeowners who have accumulated substantial equity over the past decade remain in strong positions to navigate these changing conditions successfully.

For sellers, the market demands greater preparation and strategic thinking, but Portland’s fundamental desirability and limited housing supply continue to support values. For buyers, the increased selection and negotiating leverage create opportunities not available in recent years.

Most importantly, these market changes, while significant, represent a rebalancing rather than a crisis. Portland’s housing market fundamentals remain sound, and the equity accumulation of the past decade provides 55+ homeowners with flexibility to adapt to changing conditions.

Whether you’re contemplating a sale, exploring new housing options, or planning to remain in your current home, understanding these evolving market dynamics helps ensure your housing strategy aligns with both current realities and your personal goals.

If you’d like to discuss how Portland’s shifting market conditions might impact your specific housing plans, we invite you to schedule a consultation. Together, we can examine how current trends intersect with your goals and develop a strategy that positions you for success in today’s buyer’s market environment.

Thanks for reading : )

Peter Lindberg

Lead Broker – Silver Compass Property Group

Senior Real Estate Specialist (SRES)

503-806-4277