Welcome to our June Portland Senior Housing Market report, where we’ll examine a significant shift that’s reshaping housing markets nationwide—and how it’s specifically playing out here in Portland. Recent national data reveals that the U.S. housing market now has 500,000 more sellers than active buyers, the largest gap on record according to Redfin. This represents a fundamental shift toward what experts are calling a buyer’s market.

For Portland’s 55+ community, this transition brings both opportunities and new considerations. Whether you’re contemplating selling your longtime home, exploring rightsizing options, or planning to stay put, understanding how these national trends intersect with Portland’s unique market conditions will help inform your housing decisions.

In this month’s report, we’ll explore:

- May 2025 Portland housing market performance and trends

- How national buyer/seller dynamics are manifesting locally

- Strategic implications for 55+ homeowners in different scenarios

- Pricing considerations in an affordability-challenged market

- Practical guidance for navigating Portland’s buyer’s market 2025

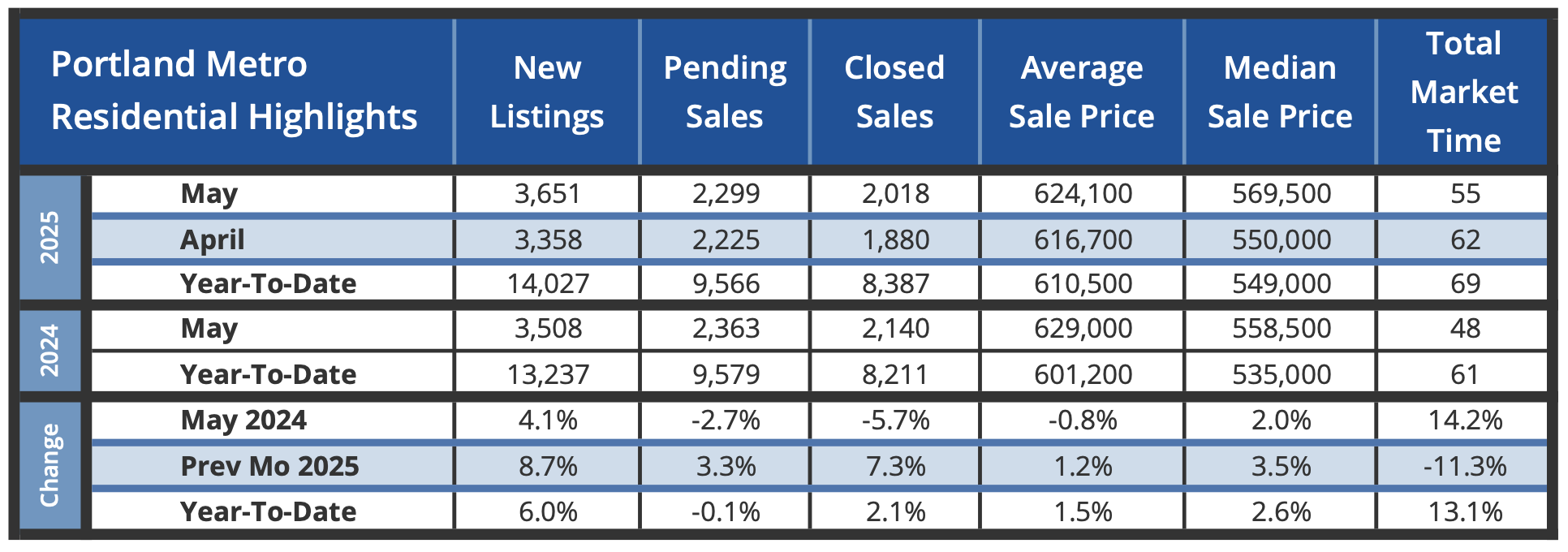

Portland Market Data: May 2025 Highlights

The Numbers Tell a Clear Story

May’s Portland metro data from RMLS confirms the national trend toward increased buyer leverage, though Portland’s transition appears more gradual than many other markets.

Market Activity:

- New listings: 3,651 properties (up 8.7% from April, up 4.1% from May 2024)

- Pending sales: 2,299 offers accepted (up 3.3% from April, down 2.7% from May 2024)

- Closed sales: 2,018 transactions (up 7.3% from April, down 5.7% from May 2024)

- Inventory: 3.3 months of supply (up from 3.1 months in April)

Price Performance:

- Average sale price: $624,100 (up 1.2% from April, down 0.8% from May 2024)

- Median sale price: $569,500 (up 3.5% from April, up 2.0% from May 2024)

- Time on market: 55 days (down from 62 days in April)

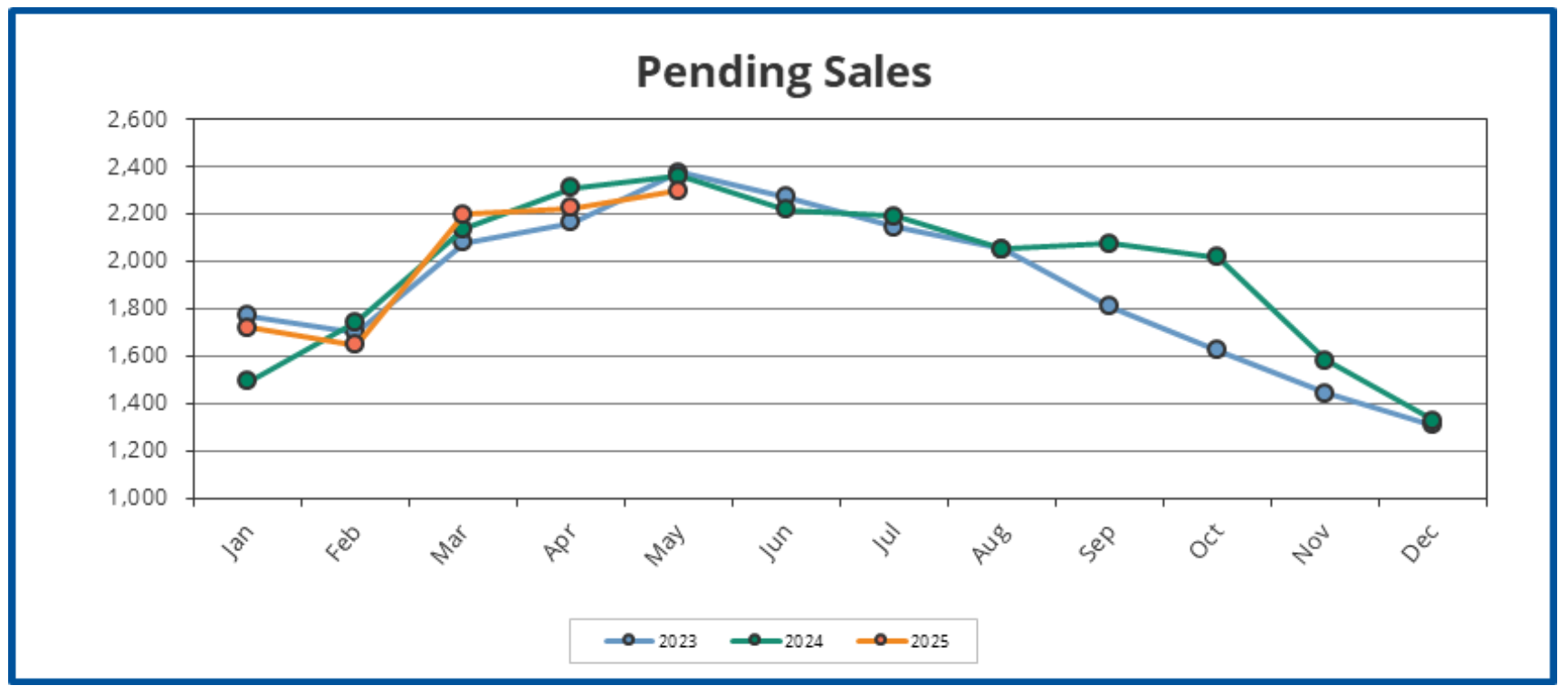

Understanding the Portland Buyer’s Market 2025 Conditions

The May data reveals a telling pattern: while new listings continue to increase significantly, the number of buyers willing to commit remains relatively flat. This growing gap between available homes and active buyers is creating the foundation for Portland’s emerging buyer’s market.

Key trend indicators:

- New listings have increased 8.7% month-over-month while pending sales grew only 3.3%

- Year-over-year, new listings are up 4.1% while pending sales are down 2.7%

- Inventory has grown to 3.3 months, the highest level since early 2022

For context, housing economists generally consider 5-6 months of inventory to represent a balanced market, so while Portland is moving in that direction, we haven’t reached full buyer’s market territory yet.

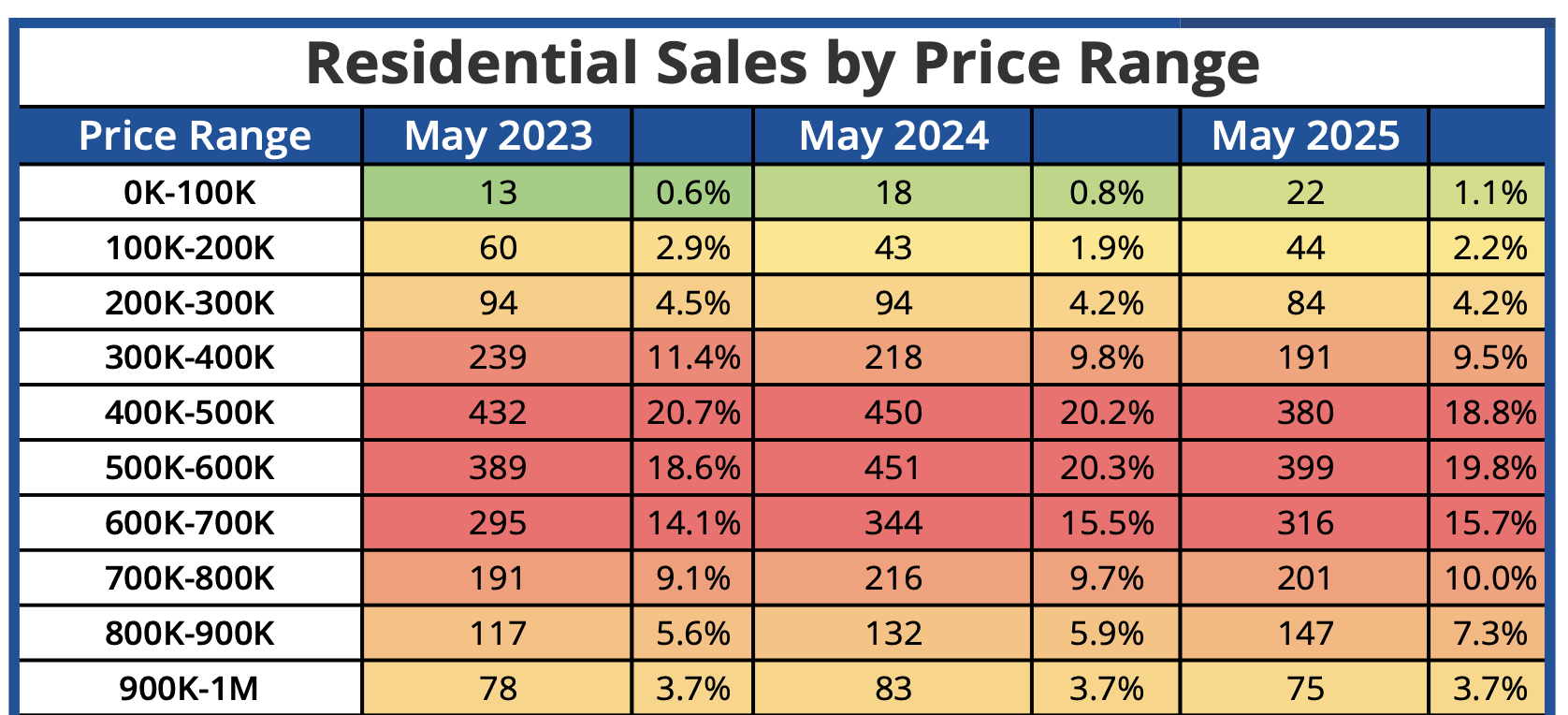

Price Range Analysis: Where the Action Is

May’s sales distribution shows continued activity across price ranges relevant to 55+ homeowners considering moves:

- $400,000-500,000: 380 sales (18.8% of market)

- $500,000-600,000: 399 sales (19.8% of market)

- $600,000-700,000: 316 sales (15.7% of market)

These three brackets represent 54.3% of all Portland metro sales, encompassing many of the single-level homes, condominiums, and active adult community properties that appeal to the 55+ market.

Notably, sales activity in the under-$600,000 range continues to face pressure from affordability challenges, as first-time buyers struggle with the combination of elevated prices and mortgage rates in the upper 6% range.

National Context: The Shift to Buyer Advantage

Understanding the 500,000 Gap

According to recent analysis by Redfin economists, the U.S. housing market now has approximately 1.9 million homes for sale but only 1.5 million active homebuyers. As Redfin Senior Economist Asad Khan notes, “The balance of power in the U.S. housing market has shifted toward buyers, but a lot of sellers have yet to see or accept the writing on the wall.”

This gap reflects several converging factors:

- Economic uncertainty fueled by tariff policies and shifting federal policies

- Mortgage rates remaining elevated in the upper 6% to low 7% range

- Many potential buyers adopting a wait-and-see approach

- Price cuts being reported on 19.1% of listings—the highest share for any May since tracking began

How Portland Compares to National Trends

While Portland is experiencing similar directional changes, our market appears to be transitioning more gradually than many regions. Several factors contribute to Portland’s relative stability:

- Limited buildable land continues to constrain supply growth

- Strong in-migration patterns maintain underlying demand

- Local employment market remains relatively robust

- Pacific Northwest desirability provides market resilience

However, Portland is not immune to broader economic pressures. National existing home sales fell 2.0% annually in April, and Portland’s 5.7% year-over-year decline in closed sales indicates similar buyer hesitation locally.

What Portland’s Buyer’s Market 2025 Means for 55+ Sellers

The New Reality for Sellers

If you’re considering selling your Portland home, the emerging buyer’s market brings both challenges and opportunities that require thoughtful strategy.

Current market advantages:

- Portland home values remain strong with modest year-over-year gains

- Decades of equity accumulation provide significant flexibility

- Quality properties in desirable neighborhoods continue attracting interest

- Lower competition from other sellers compared to peak market periods

Emerging challenges:

- Buyers have more options and are becoming increasingly selective

- Price reductions are becoming more common as seller expectations adjust

- Properties may take longer to sell than in recent years

- First-time buyer affordability constraints affect sub-$600,000 properties

Pricing Strategy in Portland’s Buyer’s Market 2025

The most critical factor for successful selling in today’s environment is realistic pricing from the start. With 81% of sellers still expecting to get their asking price or more, there’s potential for expectation misalignment that could result in extended market time.

For homes under $600,000: This price range faces particular pressure as first-time buyers struggle with affordability. Consider that a $550,000 home with a 20% down payment requires monthly payments of approximately $3,200 at current interest rates—a significant burden for younger buyers facing student loans and rising living costs.

For homes $600,000 and above: This segment may see more interest from move-up buyers and 55+ purchasers who have substantial equity from previous home sales. However, even this market segment is becoming more price-sensitive.

Strategic Timing Considerations

While there’s no need to panic-sell, the data suggests that the seller-favorable conditions of recent years are winding down. If selling is part of your near-term plans (next 6-18 months), current market conditions may be more favorable than what we might see later in 2025 or into 2026.

Redfin economists expect home prices to dip by about 1% by the end of 2025, suggesting that any price appreciation remaining this year may be limited.

Opportunities for 55+ Buyers in Portland’s Buyer’s Market 2025

The Growing Advantage

For 55+ buyers, Portland’s shifting market dynamics create several potential advantages:

Increased options: With new listings up 4.1% year-over-year and pending sales down 2.7%, buyers have significantly more properties to choose from than in recent years.

Negotiating leverage: Sellers are increasingly open to negotiations on price, terms, closing timelines, and included items. Properties that have been on the market longer than the 55-day average may present particular opportunities.

Less competition: Reduced buyer competition means less pressure to make quick decisions or waive important contingencies.

Strategic Considerations for 55+ Buyers

Interest rate timing: While mortgage rates remain elevated, they’ve shown recent modest declines. Rates dropped for the first time in a month in early June, though they remain in the upper 6% range.

Market patience: Many buyers are waiting for further rate improvements. This creates opportunities for buyers ready to move now, but it also suggests that additional inventory may become available if waiting becomes the predominant buyer strategy.

Property selection: With homes spending a median of 51 days on the market nationally, properties that have been listed longer may indicate motivated sellers willing to negotiate.

Navigating Affordability Challenges in Portland’s Market

Understanding the Broader Context

The affordability crisis affecting younger buyers has important implications for the entire housing market, including 55+ homeowners. When first-time buyers are priced out, it reduces demand for starter homes and affects the entire chain of housing moves.

Current affordability challenges include:

- Median U.S. home price at $414,000 as of April 2025

- Average 30-year mortgage rate at 6.94% as of late May

- U.S. inflation rate at 2.3% as of April

Implications for Portland 55+ Homeowners

If you’re selling a home under $600,000:

- Consider that your primary buyer pool may be limited by affordability constraints

- First-time buyer programs and assistance may influence your buyer pool

- Pricing competitively becomes even more critical in this segment

If you’re buying in any price range:

- Your substantial equity position provides advantages that younger buyers lack

- You may face less competition from first-time buyers in higher price ranges

- Consider the long-term value of properties in neighborhoods with good aging-in-place infrastructure

Strategic Guidance for Different 55+ Scenarios

For Those Planning to Sell

Immediate considerations:

- Price realistically: Use very recent comparable sales, not asking prices or older data

- Prepare for longer marketing time: Budget for potentially 60-90 days on market rather than the quick sales of recent years

- Consider timing: If your timeline is flexible, monitor how quickly conditions are changing

- Focus on broad appeal: With more buyer choice available, properties that appeal to multiple buyer types have advantages

- Longer-term planning: If selling isn’t urgent, consider how Portland’s buyer’s market 2025 conditions might evolve. The trend toward increased buyer leverage appears likely to continue, but the pace of change in Portland has been more gradual than in many markets.

For Those Considering Buying

Take advantage of conditions:

- Expand your search: With more inventory, you can afford to be selective

- Negotiate strategically: Don’t hesitate to negotiate on price, terms, or included items

- Consider off-peak timing: Properties listed during traditionally slower periods may attract less attention

- Evaluate long-term value: Focus on properties that will serve your needs for 10-15 years

For Those Staying Put

Monitor market impact on your equity: While Portland’s home values remain stable, be aware that appreciation rates may slow. This doesn’t threaten your equity but may affect refinancing opportunities or future borrowing capacity.

Consider strategic improvements: With construction material costs potentially stabilizing as supply chain issues resolve, this could be an opportune time for aging-in-place modifications or efficiency improvements.

Looking Ahead: What to Watch

Key Market Indicators

Several factors will shape how Portland’s buyer’s market 2025 evolves:

- Inventory trends: Will the gap between new listings and pending sales continue to widen?

- Interest rate direction: Any significant rate decreases could quickly shift buyer behavior

- Economic policy impacts: Continued tariff and economic policy uncertainty affects buyer confidence

- Regional employment: Portland’s job market stability influences local housing demand

National Economic Context

The broader economic environment continues to influence housing markets. Continued economic growth and concerns about inflation and government debt are expected to keep mortgage rates elevated, suggesting that current buyer hesitation may persist.

Practical Next Steps

For Sellers

- Get a current market analysis: Pricing strategy should be based on very recent sales data

- Prepare your home strategically: Focus on improvements that provide broad appeal

- Plan for longer timelines: Adjust your expectations for marketing time and closing schedules

For Buyers

- Get pre-approved: Strong financing positions you to act when you find the right property

- Expand your search criteria: Consider properties that might have been quickly sold in previous market conditions

- Work with experienced representation: Navigating seller negotiations requires market expertise

For All 55+ Homeowners

- Stay informed: Market conditions are changing more rapidly than in recent years

- Consider your timeline: Housing decisions should align with your broader life and financial planning

- Focus on fundamentals: Portland’s long-term housing outlook remains positive despite short-term adjustments

Conclusion: Confidence in Changing Conditions

Portland’s transition toward a buyer’s market represents a significant shift from the seller-favorable conditions that have dominated recent years. While this creates new considerations for 55+ homeowners, it also presents opportunities for those who understand and adapt to the changing dynamics.

The key themes emerging from Portland’s buyer’s market 2025 include increased options for buyers, the need for strategic pricing by sellers, and the importance of realistic timelines for all market participants. While national economic uncertainty continues to influence buyer behavior, Portland’s fundamental strengths—limited land supply, regional desirability, and economic diversity—provide underlying market stability.

For our 55+ community, housing decisions remain deeply personal, driven by lifestyle needs, family considerations, and financial planning rather than solely by market timing. However, understanding current market conditions helps ensure that your housing strategy aligns with both your personal goals and the realities of today’s marketplace.

Whether you’re contemplating a sale, exploring new housing options, or planning to remain in your current home, we’re here to provide insights and guidance tailored to your specific situation. The changing market conditions create both challenges and opportunities, and personalized advice helps ensure you’re positioned to make the best decisions for your circumstances.

If you’d like to discuss how Portland’s evolving buyer’s market might impact your personal housing plans, we invite you to schedule a complimentary consultation. Together, we can examine how current conditions intersect with your goals to develop a thoughtful path forward.

Thanks for reading!

Peter Lindberg, Lead Broker

Silver Compass Property Group

Senior Real Estate Specialist

503-806-4277

[email protected]