Welcome to our May Portland Senior Housing Market report. Last month, we looked at how the April 2nd tariff announcements might affect Portland’s housing scene. Now, with a month of new data since those policy changes, we may be seeing signs of how these economic shifts are actually playing out here in the Rose City.

Economists still don’t have enough hard data (it always lags by a month or two) to be certain about long term impacts and so for the moment we’re using what data we do have and our best judgment about how Portland homeowners and buyers will be affected.

For our 55+ community, we understand that housing decisions are often combined with retirement planning, family considerations, health changes, and lifestyle preferences—all of which benefit from careful thought during periods of uncertainty.

In today’s report, we’ll take a look at:

- April 2025 Portland housing market performance

- Economic developments over the past month

- Updated strategic considerations for different housing scenarios

- Practical approaches to decision-making in today’s environment

Portland Market Updates for 55+ Homeowners

What Happened in April 2025

The April numbers from RMLS show some interesting trends in the first full month since the tariff announcements.

- New homes for sale jumped 25.9% from March to April (3,358 properties) and increased 7.6% compared to April 2024

- Homes going under contract increased just 1.2% from March but dropped 3.8% from last year

- Available inventory ticked up slightly to 3.1 months

- Time on market fell to 62 days (down from 71 days in March)

The big gap between the growing number of homes for sale and the flat number of homes going under contract suggests Portland’s market might be shifting to favor buyers—with more homes to choose from but fewer people jumping in to buy them.

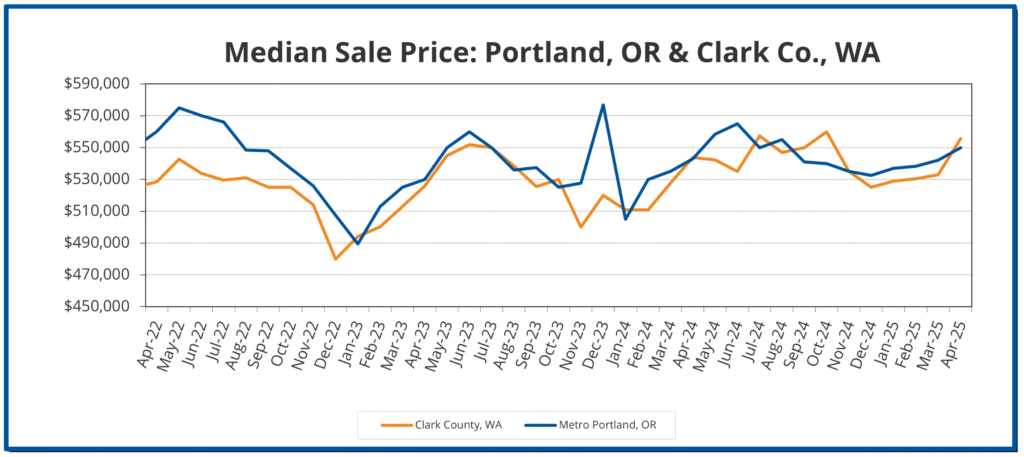

Price Trends

- Median sale price: $550,000 (up 1.5% from March)

- Average sale price: $616,700 (up 3.2% from March)

- Compared to last year: Average price dropped 0.4% from April 2024—the first drop we’ve seen in nearly two years

- Year-to-date: Average price has increased 2.6% compared to the same period in 2024

These numbers show prices are holding fairly steady despite economic worries. For long-term homeowners in Portland, your home value is likely still well-protected even with this small adjustment.

Where Most Sales Are Happening

Most home sales in April happened in these three price ranges:

- $400,000-500,000 range (20.6% of sales)

- $500,000-600,000 range (17.9% of sales)

- $600,000-700,000 range (14.9% of sales)

These three ranges continue to cover most (53.4%) of all Portland area sales, which is especially important for 55+ homeowners thinking about rightsizing.

Neighborhood Differences

April’s data shows some big differences across Portland neighborhoods that matter to 55+ homeowners thinking about moving:

- Lake Oswego/West Linn: $892,500 median price

- West Portland: $629,900 median price

- Tigard/Tualatin/Sherwood/Wilsonville: $691,500 median price

- NE Portland: $511,800 median price

- SE Portland: $454,000 median price

These differences create opportunities for moving within Portland—whether you’re looking to cash in equity from high-value areas or find better value in neighborhoods with the right amenities for your lifestyle.

How the Economic Picture Has Changed

One Month After the Tariffs

Since our April report, we’ve had four weeks to see how markets are reacting to the administration’s trade policy changes. The truth is that we’re still in something of a waiting period to see foundational economic changes with greater clarity. Nonetheless, let’s look at what we currently know.

Where Things Stand Now

- The basic 10% tariff on most imports is now in effect

- The 90-day pause on most higher-rate tariffs is in place (except for China)

- Chinese imports still face 145% tariffs

- Financial markets have settled down somewhat after the initial roller coaster reaction

How the Housing Market Is Responding

- Mortgage rates have leveled off in the mid-to-high 6% range (6.81% at the end of April)

- Home builders are dealing with higher material costs—32% lowered prices in March while only 15% raised prices

- The spring selling season is being described by analysts as “sluggish” and “in a holding pattern”

- Nationwide, March home sales hit their slowest pace since 2009, though Portland is doing better than many areas

What the Experts Are Saying

Real estate and economic experts continue to offer diverse viewpoints on current conditions:

On market trends: Recent data from Zillow shows that while inventory increased 19% nationally compared to last year, pending sales remained flat despite slightly lower mortgage rates. According to Sean Fergus, executive director of economic research at Zonda, the market “feels like it’s a little bit in a holding pattern, with so much uncertainty and volatility in the market right now.”

On buyer behavior: Chen Zhao, head of economics research at Redfin, notes that “homebuyer demand has actually been weakening since mid-2022, when interest rates began to rise,” suggesting that current hesitation may represent a continuation of existing trends rather than solely a reaction to recent economic news.

On price stability: Housing economists remain confident that any market correction will be modest. As Ken H. Johnson of the University of Mississippi observes, “Unlike the last housing crash, the nation is in the grips of a housing shortage, preventing a major decline in home prices.”

On seller expectations: Despite buyer hesitation, many sellers remain optimistic. A recent Realtor.com survey found that 81% of potential sellers think they will get their asking price or more this year, which may create some expectation misalignment in negotiations.

The overall picture is a market that’s cautious but not panicking. While the usual spring bump in home sales hasn’t happened nationwide, Portland’s market is holding up better than many regions. The gradual shift toward more homes for sale without a matching increase in buyers suggests the market might be giving shoppers more options and bargaining power.

What This Means for the Portland Senior Housing Market

If You’re Thinking About Selling

Good news:

- Portland home prices are staying strong even though some regions are weakening

- The equity you’ve built up gives you flexibility even if prices adjust somewhat

- Well-prepared, fairly priced homes are still attracting buyers

Challenges:

- The growing gap between homes for sale and homes being purchased suggests buyers might be gaining an edge

- Homes might take longer to sell if current trends continue

- Getting the price right from the start has become even more important

Big picture: The “seller’s market” might be gradually winding down. While there’s no need to rush, if selling is part of your near-term plans, the current balanced market might be more favorable than what we could see later this year.

If You’re Thinking About Buying or Rightsizing

Good news:

- Many more homes to choose from now

- Less competition than during typical spring seasons

- Some sellers might be more flexible on terms

- Mortgage rates are still lower than their recent highs

Challenges:

- Economic uncertainty makes timing tricky

- Supply chain problems might delay new construction or renovation projects

- Coordinating selling your current home while buying another takes careful planning

Big picture: The market seems to be slowly shifting to favor buyers. Patient shoppers might find even more opportunities if the number of available homes continues to grow throughout the summer.

If You’re Planning to Stay Put and Age in Place

Good news:

- You’re avoiding the complexities of buying and selling during uncertain times

- Your home equity position remains strong

- You can tackle improvement projects at your own pace

Challenges:

- Materials for renovations might cost more due to tariffs

- Planning for long-term home sustainability means thinking about both current and future economic conditions

Big picture: Consider focusing on home improvement projects that enhance both current comfort and safety. It might make sense to speed up essential projects before material costs potentially increase further.

Practical Tips for Today’s Market

For Sellers

- Price right from the start – With more homes for sale and pickier buyers, setting the right price based on very recent comparable sales is essential.

- Be ready for more detailed negotiations – Buyers are likely to negotiate not just on price but also on terms, repairs, and timelines.

- Focus on improvements that appeal to buyers – With more options available, focus on high-impact improvements that make a strong first impression.

For Buyers

- Take advantage of more choices – The big increase in homes for sale means you can afford to be pickier.

- Look for homes that have been sitting – Properties that have been on the market longer than the average 62 days might be opportunities for better deals.

- Consider locking in your rate with flexibility – Programs that lock your rate while allowing you to benefit if rates go down can provide valuable peace of mind.

For Those Staying in Their Homes

- Focus on efficiency improvements – With both energy and materials costs rising, efficiency-focused improvements often give you the best bang for your buck.

- Consider breaking big projects into phases – Tackling larger projects in stages can help manage costs while giving you flexibility.

- Look into community resources – Portland has several programs to help seniors stay in their homes, including property tax deferral options and home modification assistance.

What to Watch in the Coming Months

As we move further into 2025, several things will tell us how Portland’s housing market is responding to economic changes:

- The gap between homes listed and homes sold – If this continues to widen, we’ll shift from the seller’s market we’ve seen in PDX for awhile to a balanced or a buyer’s market.

- How often sellers reduce prices – The percentage of listings with price cuts will show how flexible sellers are becoming.

- How long homes sit on the market – Any further increase would suggest buyers are becoming more hesitant.

- What happens with mortgage rates – While hard to predict, rate changes will continue to significantly impact buying power and market activity. The best guess is that they move slightly down between now and the end of the year.

Moving Forward with Confidence

As we look at Portland’s housing market one month after April’s economic policy shifts, we’re not seeing dramatic changes but rather a gentle shift toward a more balanced market. The fundamental strengths of Portland’s housing landscape—limited buildable land, strong desirability, and excellent quality of life—continue to provide stability even as economic uncertainty creates ripples.

April’s data shows a market that’s still working well, though perhaps with more options for buyers and more concessions needed from sellers. For our 55+ community, these shifts should be viewed within the context of your broader life goals and plans. Housing decisions at this stage are rarely driven primarily by market timing but by lifestyle preferences, health, family, and long-term planning.

Whether you’re planning to sell, buy, or adapt your current home, we’re here to provide market insights and guidance tailored to your specific situation. If you’d like to discuss how recent developments might affect your personal housing plans, we invite you to schedule a free, no-pressure consultation to explore how current conditions line up with your goals.

Thank you for reading our May market update. We’ll continue to keep an eye on Portland’s housing market and broader economic developments to provide you with valuable insights in the months ahead.

Thanks for reading : )

Peter Lindberg

Lead Broker – Silver Compass Property Group

Senior Real Estate Specialist

503-806-4277