Welcome to our April Portland Senior Housing Market report, where we’ll examine Portland’s housing landscape through both local market data and broader economic factors. This month’s report comes at a time of heightened economic concerns as recent government policy changes (tariffs 😬) and market reactions (😬😬) have created ripples across various sectors, including housing.

As we analyze March’s Portland housing data, we’ll also explore the current uncertainty and what it might mean specifically for our 55+ community members. Whether you’re considering selling your longtime home, looking to rightsize, or simply monitoring your investment, our goal is to provide you with clear information to support thoughtful decision-making during this period of economic fluctuation.

In this special edition report, we’ll examine:

- Key metrics from Portland’s March housing market

- The current economic situation and its potential housing implications

- Strategic considerations for 55+ homeowners in today’s environment

- Practical approaches to housing decisions amid uncertainty

Let’s begin with a look at Portland’s housing performance in March, focusing on the trends most relevant to our 55+ community.

Portland Market Data Highlights

March 2025 Portland Market Performance

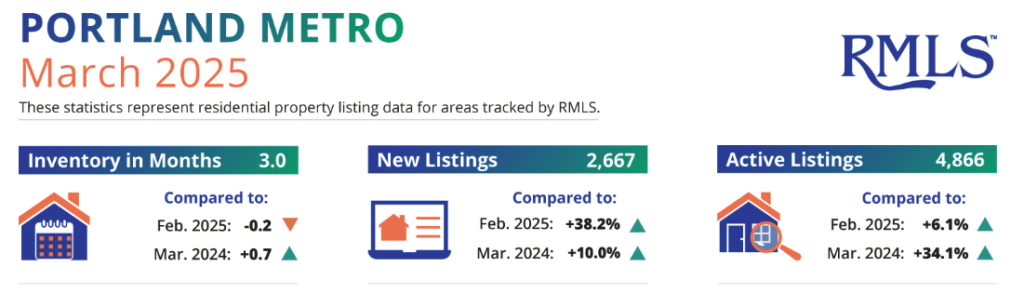

The March data from RMLS shows Portland’s housing market continuing its measured pace from earlier this year, with several key indicators showing stability before the recent government policy announcements that have since dominated economic headlines.

Market Activity & Inventory

- New listings increased 10.0% compared to March 2024, reaching 2,667 properties

- Closed sales (1,613) showed a modest 2.2% increase from the same time last year

- Inventory stands at 3.0 months, showing a balanced market neither heavily favoring buyers nor sellers

- The average time properties spent on market decreased to 71 days, down from 79 days in February

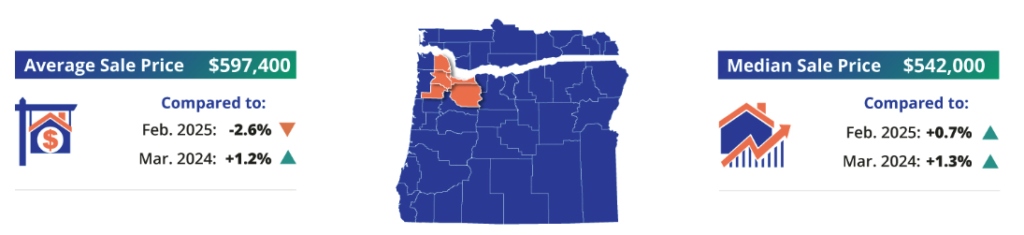

Price Trends

- The median sale price reached $542,000, showing a slight 1.3% increase from March 2024

- The average sale price settled at $597,400, up 1.2% year-over-year

- Year-to-date (January through March), the average sale price has increased 4.2% compared to the same period in 2024

Price Range Distribution

For our 55+ community members considering rightsizing options, it’s worth noting where most market activity occurred:

- $400,000-500,000 range (20.8% of sales)

- $500,000-600,000 range (19.1% of sales)

- $600,000-700,000 range (16.0% of sales)

These three price brackets accounted for 55.9% of all Portland metro area sales in March, encompassing many single-level homes and properties in active adult communities.

Regional Variations

March data continues to show significant differences across Portland neighborhoods:

- Lake Oswego/West Linn remains the premium market with a median price of $884,200

- West Portland homes sold at a median price of $633,800

- Beaverton/Aloha showed a median price of $545,000

- NE Portland homes reached a median price of $489,500

- SE Portland properties settled at a median price of $460,000

These neighborhood variations offer opportunities for those considering a move within the Portland area to potentially capture equity or find more suitable housing arrangements.

It’s important to note that this data reflects market conditions through March 31st, before the early April tariff announcements and subsequent market reactions that we’ll explore in the next section.

Economic Context

Understanding Recent Economic Developments

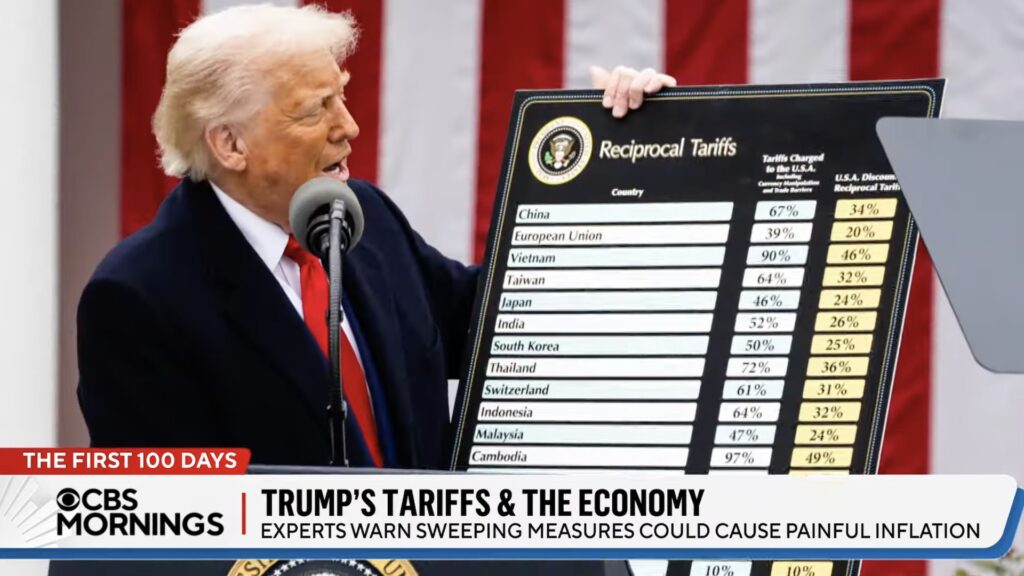

Since the release of March’s housing data, significant government policy changes have introduced new variables into our economic equation. On April 2nd, President Trump announced sweeping “reciprocal” tariffs on imports from numerous countries, with further escalation specifically targeting China. This policy approach, which the administration has called “Liberation Day,” represents a substantial shift in U.S. trade relations that may have ripple effects across various sectors, including housing.

Recent Tariff Hikes

In simple terms, tariffs are taxes on imported goods. The recently announced measures include:

- A 10% baseline tariff on most imported goods

- Higher rates for specific countries, including 20% for European Union goods

- Particularly steep tariffs on Chinese imports, which have since escalated to 125%

On April 10th, the administration announced a 90-day pause on implementing most new tariffs above the blanket 10% rate, with the notable exception of those targeting China, creating a complex and evolving economic landscape.

Market Reactions and Economic Concerns

The financial markets have responded with significant volatility to these policy shifts:

- Major U.S. stock indices experienced substantial fluctuations

- Bond yields initially dropped sharply before rising again

- Mortgage rates reflected this volatility, briefly dropping to lows for the year before stabilizing

Economic analysts have expressed varied concerns about potential impacts, including:

- Possible inflationary pressure on consumer goods, including building materials

- Uncertainty affecting business investment decisions

- Concerns about retaliatory measures from trading partners

- Potential impacts on supply chains for various sectors, including construction

Diverse Expert Perspectives

It’s important to consider the range of expert opinions on how these developments might affect housing:

On mortgage rates: “Though mortgage rates have held relatively steady so far,” according to Hannah Jones, Realtor.com senior economic research analyst, “uncertainty is the latest buzzword in the housing market and economy more generally.” This uncertainty may influence both buyers’ and sellers’ willingness to enter the market.

On construction costs: The National Association of Home Builders notes that about 22% of imported building materials for residential construction come from China, suggesting potential cost increases for new construction if tariffs remain in place.

On overall market stability: Danielle Hale, Realtor.com Chief Economist, suggests that while a significant economic downturn could lead to softer home prices, “home sales are barely above long-term lows and may not have much further to fall” – indicating a potentially resilient housing market.

On long-term housing fundamentals: Lawrence Yun, Chief Economist at the National Association of Realtors, points to “a lingering housing shortage and historically low delinquencies on mortgages” as factors that may help maintain price stability even during economic fluctuations.

What emerges from these expert perspectives is not a clear consensus but rather a recognition that we’re in a period of heightened uncertainty. In our next section, we’ll explore what these developments might mean specifically for our 55+ community members and their housing decisions.

What This Means for 55+ Homeowners

Navigating Housing Decisions in Today’s Environment

For our 55+ community, the current economic landscape presents unique considerations that differ from those facing younger homeowners. Your housing decisions typically intersect with retirement planning, healthcare considerations, lifestyle preferences, and legacy goals—all of which can be affected by market uncertainty. Let’s examine how current conditions might impact different scenarios you may be facing.

For Those Considering Selling Your Home

If you’ve been thinking about selling your longtime home, the current market presents a mixed picture:

Potential advantages:

- Portland’s home equity growth remains strong, with the average homeowner seeing consistent appreciation over recent years

- Current inventory levels (3.0 months) represent a balanced market—neither heavily favoring buyers nor sellers

- Local market data shows consistent buyer demand in numerous price ranges

- You likely have substantial equity, providing flexibility even if prices moderate

Potential challenges:

- Economic uncertainty may reduce the buyer pool temporarily

- Some buyers may delay decisions until economic conditions clarify

- If you’re planning to purchase another home after selling, you’ll also face the same uncertain market

Strategic perspective: Remember that real estate remains fundamentally local. While national economic trends matter, your specific neighborhood, property type, and price point may perform differently than broader averages. A property in a desirable Portland neighborhood with competitive pricing and features appealing to multiple buyer segments may continue to attract strong interest despite economic headwinds.

For Those Considering Buying or Rightsizing

If you’re thinking about purchasing a different home—whether downsizing, moving closer to family, or finding a more suitable layout for aging in place:

Potential advantages:

- Mortgage rates have shown recent volatility but remain lower than their recent peaks

- Increased inventory provides more options and potential negotiating leverage

- Less competition than in a more typical spring market with some buyers staying on the sidelines

- Even in uncertain times, housing needs don’t disappear—they simply evolve

Potential challenges:

- Construction material costs may increase due to tariffs, potentially affecting new home prices

- Economic uncertainty might make timing your purchase more challenging

- Selling your current home and purchasing another simultaneously requires careful coordination

Strategic perspective: Housing decisions for our 55+ community are rarely driven solely by market timing. More often, they’re prompted by lifestyle changes, health considerations, family needs, or long-term financial planning. These fundamental drivers remain valid regardless of short-term economic fluctuations.

For Those Planning to Age in Place

If you’re committed to remaining in your current home for the foreseeable future:

Potential advantages:

- You’re insulated from immediate market fluctuations affecting buyers and sellers

- Portland’s consistent home appreciation supports your long-term equity position

- You likely have a favorable mortgage rate if you’ve owned your home for several years

Potential challenges:

- Home modification costs may increase if tariffs affect building materials

- Economic uncertainty could impact retirement investments that fund aging-in-place modifications

- Property tax and insurance costs continue to rise in many Portland neighborhoods

Strategic perspective: For those aging in place, the focus shifts from market timing to thoughtful planning. This includes considering future home modifications, community connections, and financial sustainability. Current economic discussions don’t change the fundamental value of creating a home environment that supports your changing needs over time.

Practical Considerations for All 55+ Homeowners

Regardless of your specific situation, several practical considerations can help you navigate this period of economic fluctuation:

- Maintain financial flexibility – Having liquid reserves provides options during uncertain times

- Focus on long-term fundamentals – Housing decisions for the 55+ community typically have 10-20 year horizons, outlasting short-term economic cycles

- Consider your complete financial picture – Housing decisions should align with your overall retirement and estate planning

- Recognize the emotional component – Housing transitions involve both financial and emotional considerations, particularly for longtime homeowners

- Adjust timelines, not necessarily goals – Economic uncertainty might suggest extending your timeline rather than abandoning well-considered housing plans

Remember that Portland’s housing market has unique characteristics that often buffer it from broader economic trends. Our community’s desirability, limited buildable land, and strong in-migration patterns create resilience that many other markets lack.

In our next section, we’ll explore specific strategies for making thoughtful housing decisions during this period of heightened economic discussion.

Strategic Considerations

Practical Approaches to Housing Decisions in Uncertain Times

While economic headlines change daily, thoughtful housing decisions require a balanced approach that considers both immediate conditions and long-term objectives. The following strategies can help you navigate the current environment with confidence.

Practical Suggestions for Today’s Market

- Consult with a qualified financial advisor to evaluate how housing decisions align with your complete financial picture. They can help you cut through alarming headlines to focus on your specific situation – retirement planning, tax situation, and long-term financial security – and provide personalized guidance based on your actual financial position rather than general market concerns.

- Consider a pre-listing home inspection if you’re planning to sell. This proactive step allows you to address potential issues on your timeline rather than responding to buyer demands during negotiations. It’s particularly valuable during periods of market uncertainty when buyers may be more cautious.

- Explore rate lock options if you’re purchasing. With mortgage rate volatility likely to continue, lenders offer various rate lock programs that can provide certainty during your home search. Some even offer “float down” provisions that allow you to benefit if rates decrease during your lock period.

- Prioritize home features that maintain value in any market. Single-level living, updated kitchens and bathrooms, energy-efficient systems, and low-maintenance landscaping appeal to buyers across economic cycles and particularly to the 55+ demographic.

- Stage strategically if selling. Professional staging has always been valuable, but during periods of economic uncertainty, it becomes even more important to help buyers envision themselves in your space and justify your asking price.

- Consider your timing flexibility as a strategic advantage. Unlike younger buyers and sellers who may have rigid timelines due to job relocations or family changes, many 55+ homeowners can adjust their timing to market conditions, potentially waiting for optimal selling or buying opportunities.

Balancing Short-Term and Long-Term Perspectives

In periods of increased economic uncertainty, it’s helpful to distinguish between short-term market noise and long-term housing fundamentals:

Short-term considerations:

- Mortgage rate fluctuations

- Monthly market inventory changes

- Media headlines about economic policies

- Short-term stock market volatility

Long-term fundamentals:

- Portland’s persistent housing supply constraints

- Demographic trends favoring certain housing types

- Oregon’s land use laws limiting sprawl

- Your personal housing needs and preferences

- Your overall retirement and estate planning goals

While short-term factors may influence precise timing or negotiation strategies, long-term fundamentals should guide your overall housing decisions. Remember that the average homeowner stays in their property for approximately 10 years—a timeframe that spans multiple economic cycles.

Resources for Staying Informed

To make confident decisions in today’s environment, consider these trustworthy information sources:

- Local market expertise from professionals who understand Portland’s unique submarkets and the specific needs of 55+ homeowners. General economic commentary often misses the nuances of our local conditions.

- The Regional Multiple Listing Service (RMLS) provides monthly reports on Portland housing trends, offering data-driven insights beyond headlines.

- Financial advisors specializing in retirement planning can help you understand how housing decisions fit within your broader financial picture.

- Professional organizations like the National Association of Realtors and the Oregon Association of Realtors offer research on housing trends specific to older adults.

- Silver Compass’s monthly market updates (like this one) provide focused analysis on how broader trends specifically impact Portland’s 55+ homeowners.

When reviewing any information source, be mindful of potential biases and agendas. Some commentary may emphasize worst-case scenarios for dramatic effect or present short-term fluctuations as long-term trends.

A Customized Approach

Perhaps most importantly, recognize that general market analysis cannot account for your unique circumstances. Your home’s specific location, condition, and features—along with your personal financial situation, timeline, and goals—matter far more than broad economic trends.

This is why we always recommend a personalized consultation to discuss your specific situation. While we can provide general market insights in this report, your optimal strategy depends on factors unique to you and your property.

Conclusion: Moving Forward with Confidence

As we navigate this period of economic discussion and market adjustment, it’s worth remembering that Portland’s housing market has demonstrated remarkable resilience through various economic cycles. The fundamental value of your home—both as a financial asset and as the center of your daily life—remains strong despite short-term fluctuations in economic indicators.

March’s market data showed a balanced housing market in Portland with steady price appreciation and healthy activity levels. While the recent tariff news has introduced new variables into the economic equation, the impact on housing decisions should be considered within the context of your personal timeline, needs, and long-term objectives.

For our 55+ community, housing decisions are rarely driven solely by market timing. More often, they stem from meaningful life transitions, evolving needs, and thoughtful planning for the future. These fundamental drivers remain valid regardless of economic headlines.

At Silver Compass Property Group, we understand that navigating housing decisions during periods of economic change can feel challenging. That’s why we offer personalized consultations to discuss your specific situation and options. Rather than applying generic advice, we believe in creating strategies tailored to your unique circumstances, property, and goals.

If you’re considering a housing transition or simply want to explore your options in today’s environment, we invite you to schedule a complimentary, no-pressure consultation. Together, we can examine how current market conditions intersect with your personal objectives to develop a thoughtful path forward.

Thank you for reading this special edition of our monthly market report. We’ll continue to provide insights on Portland’s housing market and its implications for our 55+ community as conditions evolve.

Peter Lindberg

Lead Broker – Silver Compass Property Group

Senior Real Estate Specialist (SRES)

503-806-4277

[email protected]